Many people choose to do the wrong thing and disregard their personal financial troubles. This article can help you control of your budget the responsible way! Start getting control over your personal finances today!

Having this detailed plan will be a motivator for you also, as it provides you with a purpose to work hard to prevent overspending.

You can even sell items for neighbors on commission.You can be as creative as you want during a garage sale.

Replace old incandescent light bulbs with high-efficiency CFL light bulbs. This will help you reduce your electric bill. CFL bulbs typically last longer period of time than regular light bulbs. You will also save a lot more money because you have to buy fewer bulbs.

A number of credit card companies give rewards or discounted flight tickets to be redeemed from purchases for no additional charge. Many frequent flier miles for free or low-cost rooms.

Take advantage of online alerts that your institution. Many banks will send emails or text you when there is activity reported on your account.

Dollar Bills

If you have a lot of one dollar bills, then there may be a great way for them to use this extra money to better themselves financially. Use those dollar bills and buy some lottery tickets that can possibly win you the jackpot.

Try to arrange it so that your debit card to make payments to your credit card company every month. This setup will help keep you from forgetting about the necessary payments.

One good Forex is by allowing your profits to run. Use in moderation and don’t let greed cloud your decision making ability. Once you’ve made profit, you will also figure out the proper point at which to remove your money from the mix.

A good strategy to employ is to have money automatically transferred from your main account into a high interest savings account. At first, this might seem uncomfortable, but after a few months, you will be used to it and the money that you have will grow in no time.

The thing that you must do when trying to be wealthy is to use less than you earn. Calculate the amount that you bring home, then spend below that mark.

Make sure that you have a flexible account for spending.

Think carefully about what your feelings toward money. You can then keep going and making positive feelings later.

If you have the ability to improve your home on your own, it is not always necessary to hire a professional for some home improvement jobs.

Try working from your house if you want to save money. You have to pay for things like parking, parking and gas.

New laws state that you may have to spend a minimum credit card value.

You may not be happy with your employment situation or your income, but having some income is better than having nothing at all.

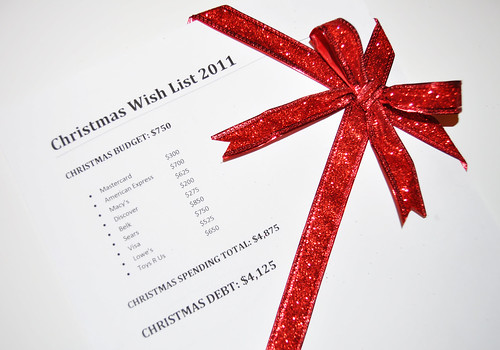

Get you personal finances back on track by creating and sticking to a budget.Regardless of whether you budget via software or paper and pencil, creating and sticking to a budget can help you to identify your financial strengths and weaknesses.It can also keep you accountable for your spending.

When thinking about moving somewhere new, keep in mind that your higher salary could reflect a higher cost of living for the area. Find out the prices of houses, rentals, and utilities cost in the area so that you don’t experience sticker shock when it is too late.

It is important to safely dispose of financial documents safely. A shredder is a relatively cheap way to dispose of documents. You could risk fraud and identity theft if you don’t properly disposed of.Protect yourself from this by being thorough.

Credit Score

Do everything you can to keep good credit score. Having good credit gets you obtain low interest rates on loan money or credit cards. Use your credit wisely so you can keep your credit score.

Shopping at a thrift store can do. There is an abundance of quality items available at thrift stores, books, clothing and books. Be sure to shop early in the day for the best variety.

It could be a smart strategy to put some money into an emergency savings fund before paying down your credit cards, especially if the use of credit cards helped to create the debt.

Look over your insurance plans. You might be overpaying for insurance. There may be cheaper options or you could be paying for things you do not need to be insured for. Cut these items out and use the money for other things.

Cell Phone

Get rid of your cell phone if you want to save more money. This suggestion can be difficult for many people, but you survived before without a cell phone, and you can do it again. Having a cell phone is not a convenience.

It is expensive and tap water for free. If you don’t enjoy how it taste, use a flavor packet like Propel to spice up the taste. These are good ways to make tap water palatable and help you save money.

Use the information presented here to address the financial issues plaguing your own peace of mind. Step by step, you will begin to see improvements in your own financial well-being and your worries will finally begin to ease.